Keys to successful succession planning

Preparing for change can create smooth business transitions

It takes a team

When you’re considering a succession planning program or ownership transition, it is critical to make sure you have the right people on your project team. At a minimum, the right people will include your current leadership team, current ownership, and a few knowledgeable and trusted advisors. Each will have a critical role in navigating the unique challenges of ownership transitions. Most importantly, the current ownership group and the succeeding one will need clear operational, tax, and legal guidance throughout the process. Having advisors that can give advice and connect the team to appropriate outside resources at the right time will be invaluable. Succession plans can take many forms, it is important to have experienced advisors that can steer conversations to practical, low cost (low tax) options.

Create the roadmap

The succession planning roadmap starts with a business valuation. Ultimately, the parties involved in the transaction must see “eye to eye” on what the company is worth. There are numerous valuation experts out there that specialize in different types of transactions. Key considerations for the team include:

- What is an appropriate valuation of the company? – Often times, outside valuation experts can provide guidance regarding industry norms and reasonable expectations.

- What are the financial goals of retiring stockholders? – Understanding what is motivating the sellers can help the team craft a roadmap that addresses their needs. In the case of unrealistic expectations, having outside guidance can help smooth over difficult discussions.

- What form of payment would be amenable to retiring stockholders? Most transactions will have elements of both cash and debt. How much of each and under what circumstances is acceptable to the sellers is unique to every succession plan.

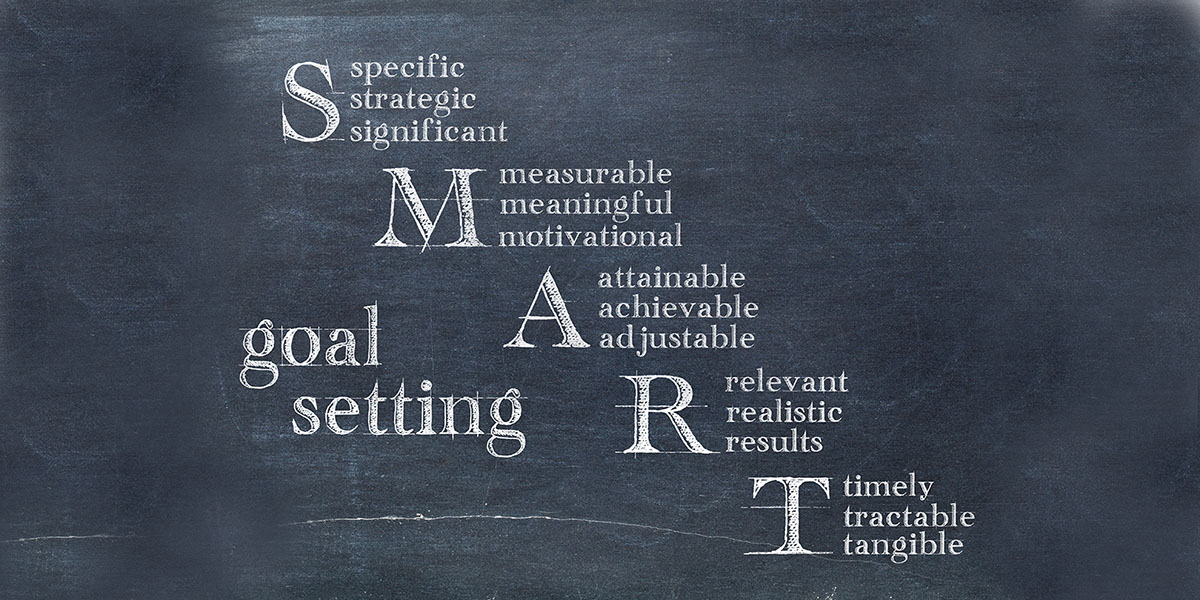

Set the milestones

Every succession plan includes key milestones for stakeholders. Milestones come in the form of role and title transition milestones as well as financial milestones. Many times, role and title transitions are already underway but have never been documented. Documenting these key role and title transitions and gaining alignment amongst the group as to what the future ownership and leadership teams look like is a key step in transitioning to new ownership.

Financial milestones should tie back to the agreed upon valuation. Visioning these milestones and coming to an agreement is often the most time-consuming part of the succession planning process. It helps to have the insights of advisors who have gone through the process or who have provided guidance to others in their journey. In addition, it helps to talk to other business owners who have already completed the process. What worked for them? What would they do differently with the benefit of hindsight?

No two succession programs will be the same, be open-minded about the process and seek to learn from those around you.

Track your progress

Finally, successful succession planning requires transparency. All stakeholders need to come to the table with the intent to succeed as a group. There should be a regular meeting cadence to discuss the details and evaluate the results of decisions being made. There will be bumps and there will be misunderstandings, having a regularly scheduled meeting to smooth out the succession journey and remind stakeholders of the priorities of the team is crucial.